Bitcoin 4 Year Cycle Explained

The Bitcoin 4 year cycle refers to a recurring market pattern driven by Bitcoin’s halving events, where the supply of new BTC is cut in half approximately every four years. Historically, this cycle has led to a bull market, followed by a peak, a deep correction, and a long accumulation phase. Understanding this cycle helps investors identify where Bitcoin may be in its broader market phase.

What Is the Bitcoin 4 Year Cycle?

The Bitcoin 4 year cycle is a market rhythm observed since Bitcoin’s creation. It is closely linked to Bitcoin halving events, which reduce the block reward paid to miners every 210,000 blocks (roughly every four years).

This reduction in new supply has historically created scarcity, influencing Bitcoin’s long-term price movements.

In simple terms:

-

Less new Bitcoin enters the market

-

Supply tightens

-

Demand remains or increases

-

Price tends to rise over time

How Bitcoin Halving Drives the Cycle

What Is a Bitcoin Halving?

A Bitcoin halving is a pre-programmed event that cuts mining rewards by 50%.

Examples:

-

2012: 50 → 25 BTC

-

2016: 25 → 12.5 BTC

-

2020: 12.5 → 6.25 BTC

-

2024: 6.25 → 3.125 BTC

Why Halving Matters

Halving creates a supply shock. If demand stays constant or increases, price pressure builds upward. Historically, major bull markets followed each halving with a delay of several months.

The 4 Phases of the Bitcoin Market Cycle

1. Accumulation Phase

-

Happens after a bear market

-

Low volatility, low interest

-

Smart money accumulates

2. Bull Market Phase

-

Price accelerates upward

-

Media attention increases

-

Retail investors enter

3. Distribution Phase

-

Price reaches euphoric levels

-

Long-term holders take profits

-

Volatility increases

4. Bear Market Phase

-

Sharp corrections (up to 80%)

-

Capitulation and fear

-

Cycle resets

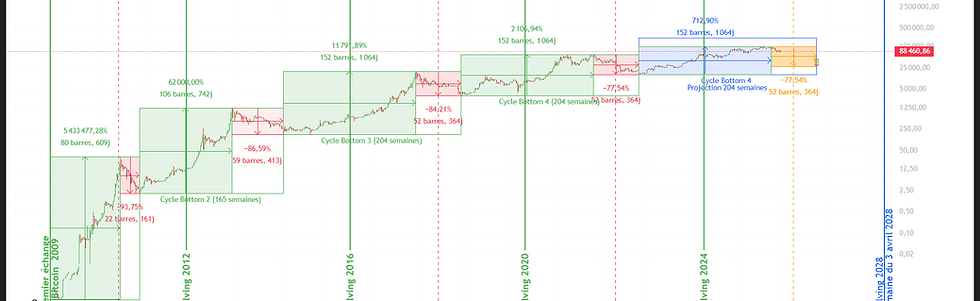

Bitcoin 4 Year Cycle History (2012–2024)

Historically, Bitcoin followed this pattern:

-

2012 halving → 2013 bull run

-

2016 halving → 2017 bull run

-

2020 halving → 2021 bull run

-

2024 halving → market evolving

-

Each cycle showed diminishing returns but increasing market maturity.

Is the Bitcoin 4 Year Cycle Broken?

This is one of the most debated questions today.

Arguments that the cycle is changing:

-

Institutional investors (ETFs, funds)

-

Larger market capitalization

-

Macroeconomic factors (interest rates, liquidity)

-

Lower volatility compared to early cycles

Reality:

The cycle may not be “broken,” but evolving. Halving still matters, but it is no longer the only driver.

Risks of Relying Only on the 4 Year Cycle

-

Past performance ≠ future results

-

Cycles can lengthen or flatten

-

External shocks can override halving effects

Smart investors combine the cycle with:

-

On-chain metrics

-

Macro indicators

-

Risk management

Bitcoin 4 Year Cycle vs Other Models

-

Stock-to-Flow

-

Pi Cycle Top Indicator

-

On-chain valuation metrics

-

No model is perfect. The 4 year cycle is a framework, not a guarantee.

Frequently Asked Questions (FAQ)

What is the Bitcoin 4 year cycle?

It is a recurring market pattern linked to Bitcoin halving events, historically influencing price trends.

Does Bitcoin always follow a 4 year cycle?

No. While patterns exist, market conditions evolve and cycles can change.

Is 2025 a bull market year for Bitcoin?

Historically, post-halving years often see strong performance, but outcomes are not guaranteed.

Can the Bitcoin cycle fail?

Yes. Structural changes, regulation, or macroeconomic shocks can disrupt historical patterns.